Credit Card Processing Payment

Credit Card Processing Payment - Payment card industry (pci) compliance is a set of standards that all businesses must comply with when storing, processing and transmitting credit or debit card information. What is credit card processing and how does it work? The customer initiates a payment with their credit card, and the payment information is shared with the merchant. Learn how credit card processing works, what the fees look like, and how you optimize payments online and in person. We offer sophisticated level 2 and level 3 credit card information processing capabilities, enabling businesses to qualify for lower interchange rates. On a $1,000 purchase, the business must pay $20 to the payment processing network for the card used by the customer.

Our platform automatically captures and submits the. Credit card processing fees are the fees that a business must pay every time it accepts a credit card payment. For each processor, we’ll break down the pricing, benefits, drawbacks, and which types of businesses should consider the service. Common payment methods include swiping, chip cards, contactless payments, and mobile wallets. This approach reduces processing time and minimizes errors, creating a more productive payment ecosystem.

5 Best Credit Card Processing Companies of 2021 INSCMagazine

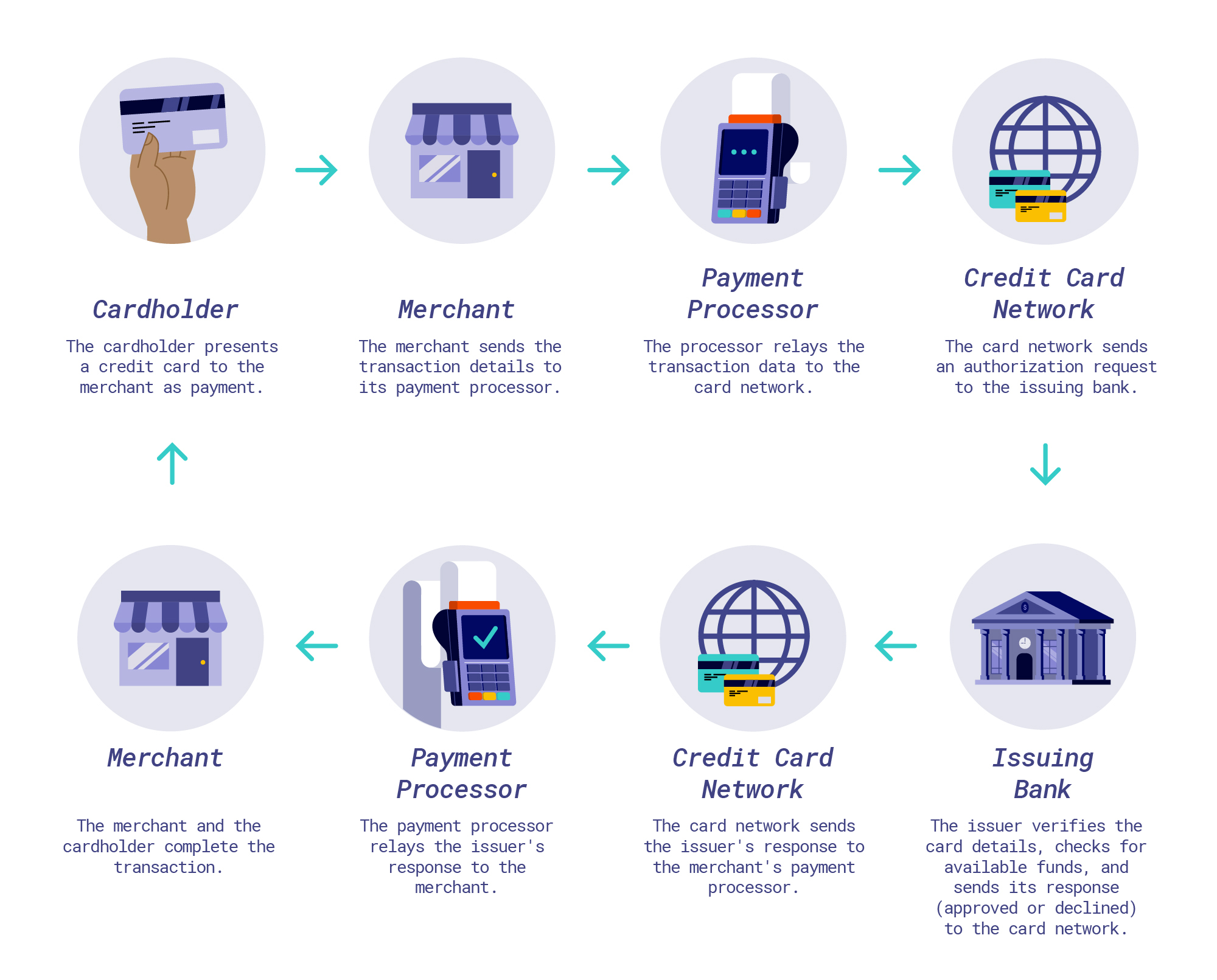

Understanding credit card payment processing before diving into the setup process, it's crucial to understand how credit card processing works. Learn how credit card processing works, what the fees look like, and how you optimize payments online and in person. Credit card processing starts at the consumer level: Credit card processing involves several components that work together. We compared.

Payment Processing Architecture. Payment processing is what happens

Credit card processing is the system that enables businesses to accept credit card payments from their customers. Credit card processing starts at the consumer level: Understanding credit card payment processing before diving into the setup process, it's crucial to understand how credit card processing works. Credit card processing fees are around 2% of a transaction. If a default credit.

How Credit Card Processing Fees Work The Ultimate Guide

It’s important to understand how credit card transaction processing works and how to set up a credit card processing system. If you click this button, you must complete the remaining steps in this procedure. If a default credit card exists in the customer record that uses the processing code selected for the current transaction, that credit card is selected by.

The Credit Card Payment Process

But with a myriad of payment options hitting the market, deciding which service will serve you best is. Joist offers a simple way to add credit card payments to your invoicing software. The pmt process credit card screen appears. Online payment processing lets you accept debit card, ach and credit card payments from customers shopping online. The customer initiates a.

Merchant services explained Dayton Chamber

Joist offers a simple way to add credit card payments to your invoicing software. Credit card processing fees are around 2% of a transaction. The pmt process credit card screen appears. From one of our partners — 5 easy ways to accept credit cards We offer an online payment processing service that enables you to accept bank or credit card.

Credit Card Processing Payment - When a customer pays for their purchases, we process the payment and transfer the funds to your paypal account. When a customer makes a purchase, their payment information travels through several parties: It offers valuable information on topics such as interchange fees, pci compliance, and mobile payments. Our platform automatically captures and submits the. Credit card processing fees are the fees that a business must pay every time it accepts a credit card payment. We offer sophisticated level 2 and level 3 credit card information processing capabilities, enabling businesses to qualify for lower interchange rates.

We looked at factors such as transparent pricing, business tools and integrations and more. A payment processor facilitates electronic payments between banks and merchants, while a payment gateway allows for online transaction processing. Credit card processors make it possible for you to take credit card payments by connecting the various services involved in the process. Credit card processing is the system that enables businesses to accept credit card payments from their customers. It offers valuable information on topics such as interchange fees, pci compliance, and mobile payments.

What Is Credit Card Processing And How Does It Work?

When a customer makes a purchase, their payment information travels through several parties: But with a myriad of payment options hitting the market, deciding which service will serve you best is. The full process involves a few different phases behind the scenes. Credit card processing fees are the fees that a business must pay every time it accepts a credit card payment.

If A Default Credit Card Exists In The Customer Record That Uses The Processing Code Selected For The Current Transaction, That Credit Card Is Selected By Default.

By facilitating easy, secure transactions, credit card processing broadens the range of payment options available to customers and increases sales. Credit card processing fees are around 2% of a transaction. The pmt process credit card screen appears. Click one of the following buttons:

It Offers Valuable Information On Topics Such As Interchange Fees, Pci Compliance, And Mobile Payments.

With payments on, you can accept payments via credit card, paypal, venmo (us only, apple pay, google play, and more online options). All you have to do is enable payments in the joist app settings. This approach reduces processing time and minimizes errors, creating a more productive payment ecosystem. Credit card processing allows merchants to accept credit card payments from customers.

This Payment Processing Guide Provides A Clear, Concise, And Complete Look At How Businesses Accept And Process Payments.

Credit card processing involves three main stages: Credit card processors make it possible for you to take credit card payments by connecting the various services involved in the process. If you click this button, you must complete the remaining steps in this procedure. Online payment processing lets you accept debit card, ach and credit card payments from customers shopping online.