How Do Credit Cards Figure Out Minimum Payments

How Do Credit Cards Figure Out Minimum Payments - Tips for managing your credit card payments. There are a number of actions to take if you miss a credit card payment: Your card company may charge you for paying your bill after the due date. When you receive your credit card statement, it typically includes the total outstanding balance, the minimum payment due, the due date, and the annual percentage. In this comprehensive guide, we’ll delve into the intricacies of determining the minimum payment on a credit card, shedding light on the factors influencing it and providing. A credit card minimum payment is the minimum amount you must pay by the due date to keep your account in good standing.

What is a credit card minimum payment? Typically, your minimum monthly payment is either: What is minimum cibil score required for credit card? The minimum payment will either be a percentage of your balance or a fixed dollar amount. Issuers typically have a specific floor for minimum payments, often between $20 and $40.

Things you need to know if you’re only able to make minimum payments on

When you receive your credit card statement, it typically includes the total outstanding balance, the minimum payment due, the due date, and the annual percentage. Find out the difference in interest between a fixed payment and the minimum credit card payment with bankrate's financial calculator. Tips for managing your credit card payments. Others may require a percentage, plus any late.

How To Find Out Your Calculate Minimum Payment On Credit Card LiveWell

To avoid falling into the trap of paying only the. Expect to pay the greater amount of the two. If your credit card balance is below this number, then your minimum payment will be. There are a number of actions to take if you miss a credit card payment: Typically, your minimum monthly payment is either:

Minimum Credit Card Payment What You Need To Know LowerMyBills

You can see how the minimum payment on your credit card is calculated by looking at your monthly statement, which will list the minimum payment as well as the rules for. Typically, the minimum payment is determined based on a combination of the outstanding balance, accrued interest, and a predetermined percentage of the total amount. Pay the minimum as soon.

What Is a Minimum Payment for a Credit Card LiveWell

In this comprehensive guide, we’ll delve into the intricacies of determining the minimum payment on a credit card, shedding light on the factors influencing it and providing. Typically, the minimum payment is determined based on a combination of the outstanding balance, accrued interest, and a predetermined percentage of the total amount. Issuers typically have a specific floor for minimum payments,.

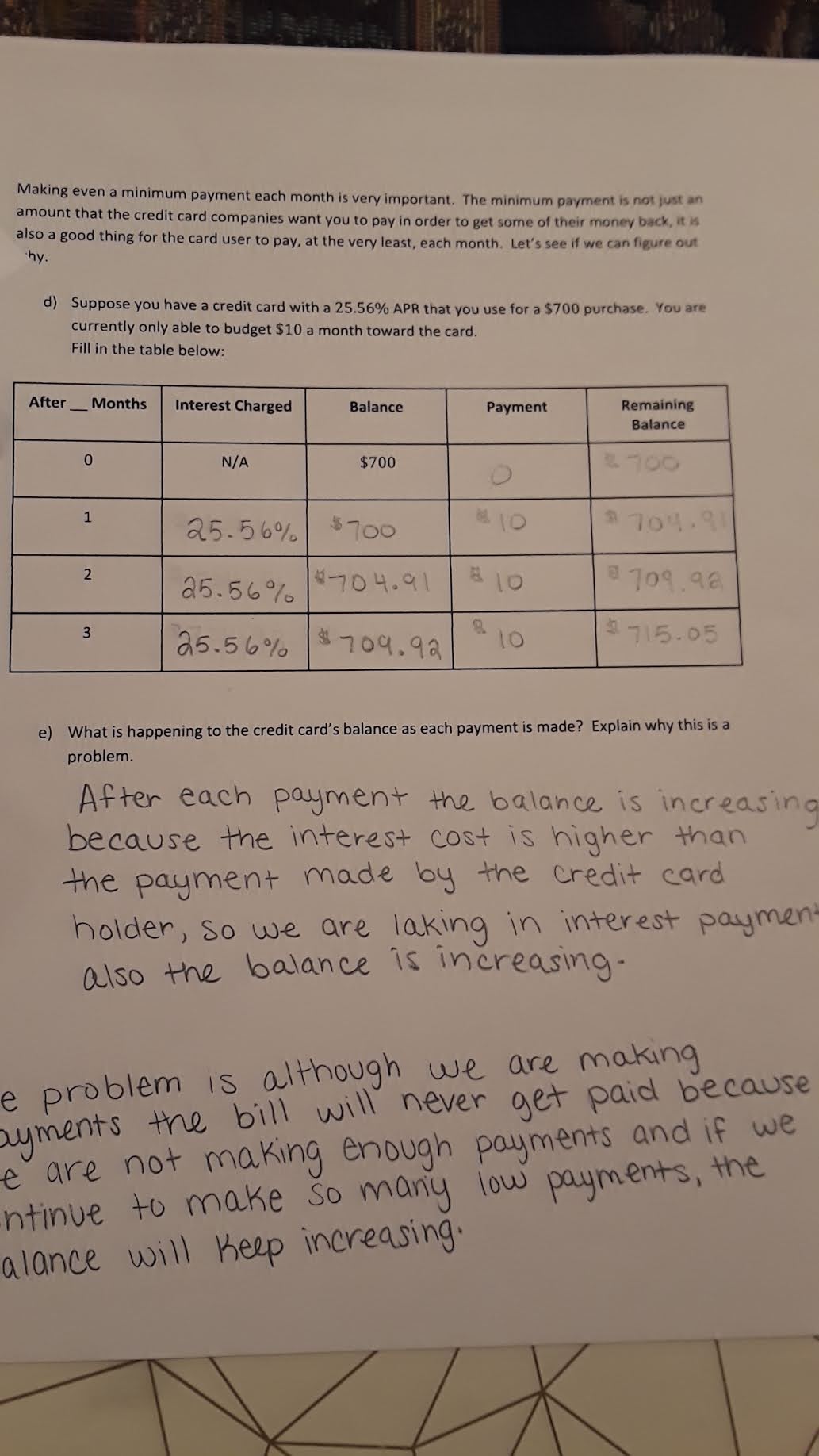

Solved Making even a minimum payment each month is very

Tips for managing your credit card payments. What is a credit card minimum payment? In this comprehensive guide, we’ll delve into the intricacies of determining the minimum payment on a credit card, shedding light on the factors influencing it and providing. Others may require a percentage, plus any late fees and accrued interest. Expect to pay the greater amount of.

How Do Credit Cards Figure Out Minimum Payments - There are a number of actions to take if you miss a credit card payment: Generally speaking, the minimum payment is based on your credit card balance. Expect to pay the greater amount of the two. By paying only the minimum, you’d need more than 20 years to pay off the credit card (assuming you didn’t use it again), and the total interest you’d pay could exceed $5,000. How do you find out your minimum payment? If your credit card balance is below this number, then your minimum payment will be.

For example, if you had a $2,000 credit card balance, a 3% minimum payment would be $60. The average late fee for major credit card issuers is $32, according to the consumer. In this comprehensive guide, we’ll delve into the intricacies of determining the minimum payment on a credit card, shedding light on the factors influencing it and providing. What is a credit card minimum payment? Others may require a percentage, plus any late fees and accrued interest.

The Average Late Fee For Major Credit Card Issuers Is $32, According To The Consumer.

Typically, the minimum payment is determined based on a combination of the outstanding balance, accrued interest, and a predetermined percentage of the total amount. Issuers typically have a specific floor for minimum payments, often between $20 and $40. Typically, your minimum monthly payment is either: You have 30 days before your issuer reports the missed.

Paying At Least The Minimum Will Also Help You.

What happens if you don't make the. Generally speaking, the minimum payment is based on your credit card balance. Tips for managing your credit card payments. To avoid falling into the trap of paying only the.

Others May Require A Percentage, Plus Any Late Fees And Accrued Interest.

A credit card minimum payment is the minimum amount you must pay by the due date to keep your account in good standing. You can find the minimum payment required by your credit card, along with the due date for that payment, on the monthly. What is minimum cibil score required for credit card? 1) a fixed dollar amount, or, 2) a small percentage of your balance.

Credit Card Issuers Calculate The Minimum Payment Using A Formula That Considers Your Outstanding Statement Balance, Credit Card Interest Rate (Apr), And Any Fees.

For example, if you had a $2,000 credit card balance, a 3% minimum payment would be $60. What is a credit card minimum payment? If your credit card balance is below this number, then your minimum payment will be. In most cases, credit card companies calculate your minimum payment based on a percentage of your outstanding balance, typically between 1% and 3%.